Alphabet (GOOG): Powering Ahead — What’s Behind the ~25% Rise?

By Predictive Pick | January 6, 2026

1. Company

Snapshot

Alphabet Inc. (Parent of Google)

- Ticker

Symbols: GOOG / GOOGL

- Sector:

Technology – Internet Services, Cloud, AI, and Digital Advertising

- Market

Position: One of the world’s largest tech firms

with a diversified portfolio, spanning search, video, cloud

infrastructure, devices, and artificial intelligence.

- Core

Business Pillars:

- Google

Search & Ads – the backbone of

Alphabet’s revenue stream.

- YouTube – a

global video leader with rapidly growing ad and subscription revenues.

- Google

Cloud – delivering

infrastructure, AI, and enterprise solutions (one of the fastest-growing

segments).

- Platforms

& Devices – Android OS, Pixel

hardware, and related ecosystems.

- Artificial

Intelligence – Gemini and other

generative AI models integrated across products.

- Recent

Financial Performance (Q2 FY2025):

- Revenue:

~$96.4 billion, up ~14% YoY.

- Operating

Margin: ~32.4%, reflecting strong efficiency and scale.

- Google

Cloud: +32% YoY growth, now a core driver of profitability.

- Key

Insight: Alphabet continues to evolve beyond

advertising, with cloud and AI becoming increasingly important to its

long-term growth story.

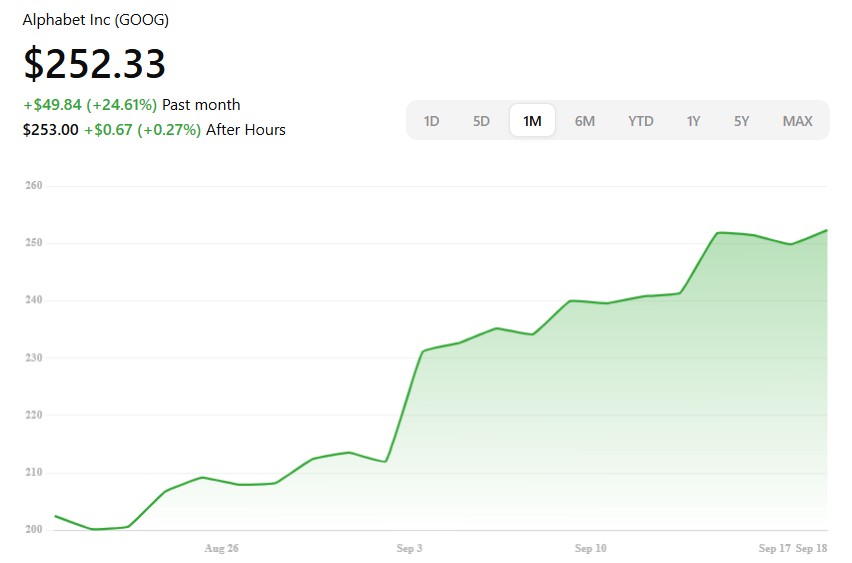

2. Why the

~25%+ Return in Last ~1.5 Months?

Here are the main catalysts:

- Regulatory

Relief / Antitrust Headwinds Easing

A favorable US court ruling recently allowed Alphabet to retain control of key assets like Chrome and Android, which removed a big overhang for investors. - Artificial

Intelligence Momentum

AI-driven features (AI Mode, Gemini) are getting traction. Google Cloud is becoming more profitable and visible. Experimental investment in AI infrastructure & chips shows long-term thinking. - Strong

Top-Line Growth Across Multiple Segments

YouTube ads, Search, and Cloud all showing double-digit growth. Not just one business — multiple engines firing. - Market

Sentiment & Valuation Comparisons

As peers in “Magnificent Seven” or Big Tech saw mixed results or regulatory pressures, Alphabet is emerging as possibly “best risk/reward” among them. Also, forward P/E is relatively reasonable compared to peers given its scale and growth.

3. Full

Fundamental Analysis

|

Metric |

Value / Trend |

Implication |

|

Revenue

Growth YoY |

~14%

overall; Cloud ~32% growth. |

Strong

demand, diversification beyond just search ads. |

|

Net

Margin / Profitability |

Net

margin ~30-31%, ROE ~31.8%. |

High

profits; efficient business at scale. |

|

Operating

Margin |

~32.4% in

Q2 2025. |

Suggests

cost control plus high-margin segments like Cloud are growing. |

|

Earnings

Growth Rate |

Long-term

~14-17% EPS growth. |

Healthy

growth built into valuation. |

|

CapEx /

Investment |

Large

investments in AI infrastructure. Expanding capital spending to support cloud

& AI. |

Could

weigh near-term free cash flow but supports future scale. |

4.

Technical & Momentum View

- Price

Trend & Moving Averages: Alphabet is well above its 50-day,

200-day SMAs. The 200-day average sits much lower, indicating a strong

uptrend.

- Support

& Resistance Zones: Support likely around mid-$200s (where

price previously consolidated). Resistance near recent highs (just under

record highs).

- RSI

& MACD: RSI in the 60-70s (strong but not wildly

overbought), MACD positive, showing bullish momentum.

- Volume

& Relative Strength: Strong relative strength compared to

peers. The stock’s been outperforming many in the tech set.

5. What

Could Go Wrong? Key Risks

- Regulatory

Risk Still Real: Even though one ruling helped, antitrust

pressure globally (US, EU, Asia) remains. Potential fines or regulations

could hurt ad-business or platform control.

- High

Investment Costs: Heavy spending on AI infrastructure,

chips, data center, etc., may compress near-term margins / cash flow.

- Competition

in AI & Cloud: Microsoft, Amazon, NVIDIA, and others

are pushing aggressively. The race is expensive and margins could shrink

if differentiation weakens.

- Macroeconomic

/ Ad Market Weakness: If ad spend softens (due to recession,

inflation, interest rates), a big chunk of Alphabet’s revenue could be

impacted.

6. What’s

the “Smart Play” Here?

For those who are watching:

- Entry

Strategy: If you missed part of the run, consider

waiting for small pullbacks or consolidations (near moving average

support).

- Hold /

Target: With current momentum and assuming

growth holds, there’s room to move toward record highs (or slightly above)

in the medium term.

- Risk

Management: Use stop-loss zones below key support;

don’t over-leverage, because upside is balanced by regulatory &

investment risk.

7. Verdict

Alphabet is showing many signs of a

“compounder on steroids” right now: strong diversified revenue growth (cloud +

search + ads), rising regulatory clarity, and big bets on AI and infrastructure

being rewarded by the market. The ~25%+ return in ~1.5 months isn’t just hype —

it has real business reasons behind it.

For long-term investors who believe AI + cloud

+ scalable platforms will dominate the next decade, GOOG looks like a stock to

hold. For shorter-term traders, there’s risk, but also reward if you get in

around support or on strength.

⚠️ Disclaimer

This article is for educational and

informational purposes only. It is not financial advice, nor a

recommendation to buy or sell any security. Always do your own research and

consult with a licensed financial advisor before making investment decisions.

Subscribe to our Blogs

Get the latest blog updates directly in your inbox.