IVZ: The Smart Money’s Under-the-Radar Play?

By Predictive Pick | September 1, 2025

1. Company Snapshot

Ticker / Sector / Market Cap: IVZ, Asset & Investment Management, Market Cap ~$9.7 billion.

Business Model: Manages active, passive, alternative, fixed income, equity, and multi-asset strategies globally, with offices in 20+ countries.

Assets Under Management (AUM): Reached record levels of ~$2 trillion, up ~17% YoY. Long-term average AUM ~ $1.34 trillion (+12% YoY).

2. Why Now? (Catalysts)

Strong Net Inflows: Q2 saw net long-term inflows of $15.6 billion, offsetting EPS miss tied to preferred stock repurchase costs.

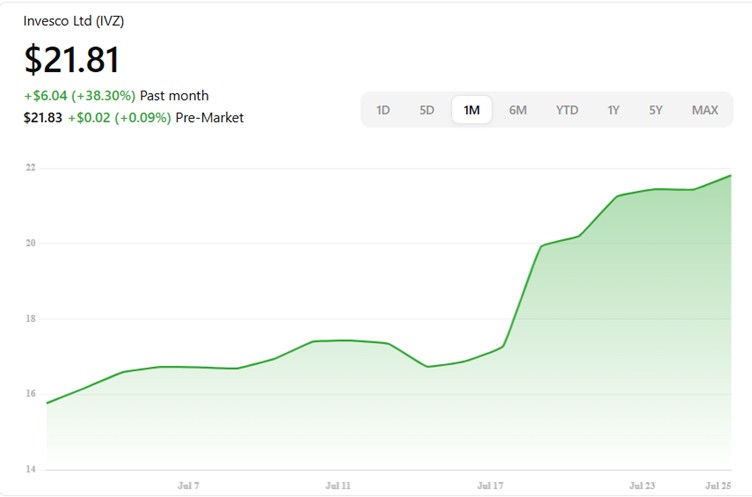

Technical Setup: IVZ formed a “cup without handle” chart base with a $19.55 buy point, and recently broke above it. RS rating now climbed to 87, surpassing the bullish benchmark of 80.

Industry Momentum: Rising demand for diversified global investment management and fixed income assets supports growth. Continued expansion into active fixed income is a recent highlight.

3. Fundamental Analysis

Revenue & EPS Trends: Revenue grew ~1.7% YoY to $1.10b in Q2; EPS grew ~11% YoY but missed expectations by ~12%. Adjusted EPS was $0.36 vs. $0.40.

Growth Outlook: EPS growth expected to run at ~7.5% CAGR over 5 years; revenue growth accelerating modestly to ~3.2% per year.

Valuation: Current P/E ~12.4×, forward P/E ~11.3× — trading well below industry peers; ranked cheaper than ~64–80% of peers on P/E, EV/EBITDA, and P/FCF. PEG ratio elevated (~4.6) reflecting still modest growth expectations.

Dividend Profile: Pays quarterly dividend of ~$0.21/share (yield ~3.8%), with modest cuts over recent years but still maintained payout.

4. Technical Analysis & Momentum

Chart Breakout: Successfully cleared the $19.55 cup‑without‑handle pattern buy point; now trading near its 52‑week high of $21.84.

Relative Strength (RS) Rating: Upgraded from ~74 to 87, a strong bullish signal indicating leading price action.

Momentum Indicators: RSI reportedly extended (~88), but trend momentum remains strong. Analyst consensus remains generally neutral to hold; trading sentiment leaning toward tactical opportunity.

5. Risks & Watch Points

EPS Miss & Volatility: EPS shortfall due to preferred stock repurchase cost — implies earnings may remain volatile in periods of corporate activity or restructuring.

High RS Might Stall: Elevated RSI and rapid price moves could lead to short-term consolidation or pullback.

Growth vs. Valuation: While IVZ is cheap on classic multiples, future EPS growth remains modest, limiting upside unless inflow acceleration continues. PEG ratio remains elevated.

6. Smart Entry Strategy

Watch Zone: Entry range defined by the buy point of $19.55 and up to 5% above (~$20.50), as part of normal technical rules.

Phased Buy Approach:

Step 1: Light starter position near breakout point (~$21)

Step 2: Add on any dip toward $20–$20.50 band

Step 3: Assess position if volume confirms breakout with AUM/inflow strength

Target & Stop:

Target: $25–$26 assuming steady inflows and earnings recovery

Stop: Below $19.50 invalidating breakout structure

7. Final Take

Invesco is riding recent AUM momentum and better-than-expected asset inflows, while still trading at attractive multiples. Despite an EPS miss due to corporate costs, its technical breakout and strong RS signal bode well for near-term gains. For medium-term investors, a disciplined, phased entry on breakout or dips may offer a risk-managed way to diversify into the recovering asset-management sector.

Disclaimer

This article is for educational purposes only and not financial advice. Investing involves risk, and past performance is not indicative of future results. Please consult a licensed advisor before making investment decisions.

Subscribe to our Blogs

Get the latest blog updates directly in your inbox.