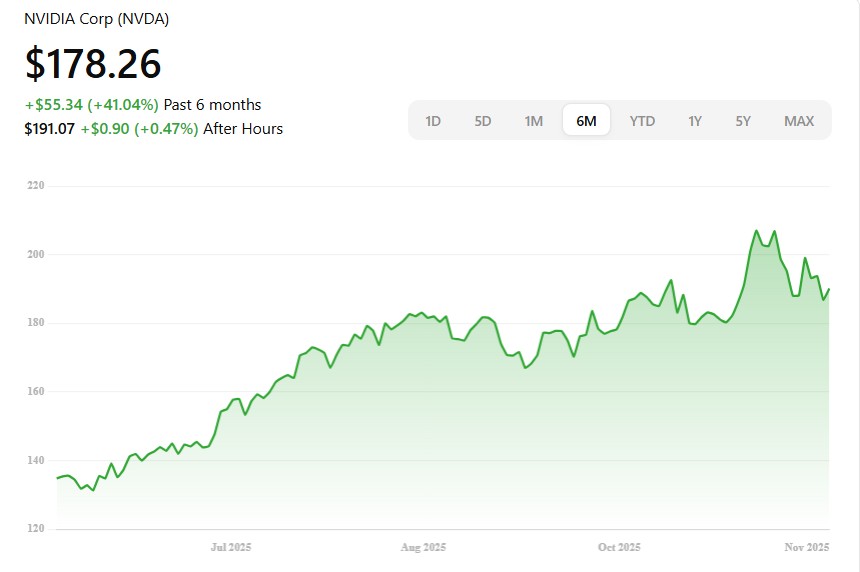

NVIDIA Is a Short Squeeze Brewing?

By Predictive Pick | November 15, 2025

Why the $100 (or Near It) Matters as Support

- Technical

Anchor

While many analysts point to $100 as a psychological support, there are also references to longer-term moving averages clustering near that level. StockPal+2Ithy+2 - Sentiment

Reset Point

A dip or retracement toward $100 could indicate a meaningful de-risking or correction phase. For traders who believe in NVIDIA’s long-term strength, this area represents a high-conviction buy zone. - Range-Bound

Dynamics

Some technical analysts suggest that if NVDA fails to decisively break below the $100–110 band, we could see a squeeze move as short-sellers rush to cover. StockPal

Fundamental Strength: Why NVDA’s Core Business Still

Excites

- AI

and Data-Center Leadership: NVIDIA reported record Data Center

revenue, driven by strong enterprise and cloud demand. NVIDIA Investor Relations

- Long-Term

Growth Model: According to Morningstar, NVIDIA’s data-center segment

could grow significantly through fiscal 2028, with a modeled 10–12% CAGR.

- Powerful

Ecosystem: From generative AI to autonomous systems and

high-performance computing, NVIDIA’s GPU platform remains central to the

infrastructure of tomorrow.

Near-Term Technical Risks And the Case for a Short Squeeze

- Death

Cross Risk: Some analysts note that NVDA could be forming bearish

technical signals, such as a “death cross.”

- Volatility

Risk: With the stock hovering around critical support, even modest

negative headlines or macro shocks could trigger heavy selling.

- Short

Squeeze Potential: If NVDA holds $100 with strong volume, a sharp

bounce could force short positions to cover aggressively, propelling the

stock higher quickly.

Catalysts That Could Trigger a Rally

- AI

CapEx Resumption: Renewed capital expenditure by cloud providers and

large enterprises could further fuel GPU demand.

- New

Product Cycles: Upcoming chip launches (e.g., next-gen AI

architectures) could reignite bullish sentiment.

- Regulation

Relief: Any easing in export rules for advanced chips could unlock

additional international demand.

- Earnings

Beats: Better-than-expected earnings could validate recovery and

strengthen technical support zones.

Risks That Could Break the Support

- Geopolitical

Headwinds: Export restrictions to China or other nations could weigh

on growth and sentiment.

- Slowing

AI Budget Growth: If companies retrench on AI infrastructure spending,

demand for NVIDIA’s GPUs could moderate.

- Competition:

Rival firms (AMD, Intel, other AI chipmakers) may erode NVIDIA’s dominance

over time.

- Macro

Pressures: Rising interest rates or broader market downturns could

lead to further downside.

Conclusion

NVIDIA remains a dominant force in AI and compute

infrastructure, and its fundamental trajectory is strong. However, the technical

setup around the $100 level is unusually important: it could act as a major

support zone or, if broken hard, lead to

more downside. For traders and short-term investors, this is a high-stakes

inflection point.

If NVIDIA manages to defend this area, a short squeeze

could ignite, pushing the stock materially higher in a short period. But if

support fails, a test of lower levels may follow. Either way, risk management

is crucial.

Disclaimer

This article is for informational and educational

purposes only. It is not a buy or sell recommendation. NVDA is a

volatile stock, and any trading decision should be based on your own research

or in consultation with a qualified financial advisor.

Subscribe to our Blogs

Get the latest blog updates directly in your inbox.