Oracle (ORCL): Why This Cloud & AI Stock is Surging Now

By Predictive Pick | September 1, 2025

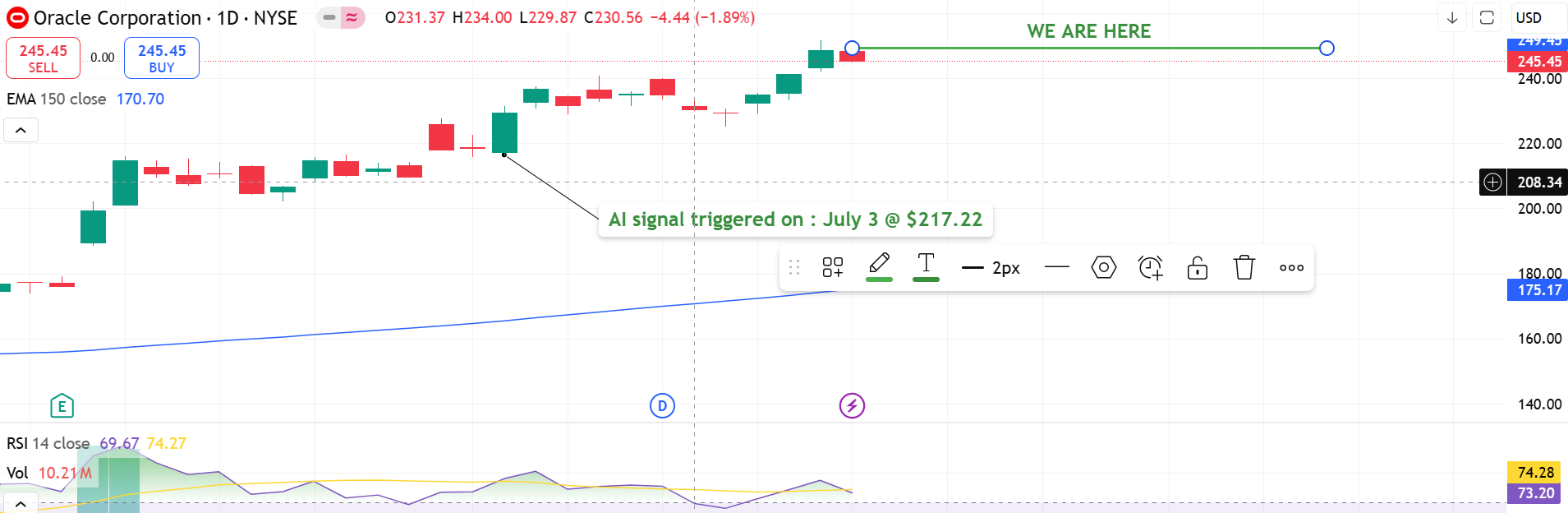

Oracle Corporation (NYSE: ORCL) is red hot right now. Since early July, this tech giant has seen its stock jump, signaling strong investor confidence in its cloud and AI future.

ORCL's Recent Ascent: The Numbers

As of Friday, July 18, 2025, Oracle (CMP $245.45, Stop Loss $228) has surged over 12% since July 4th. Technical indicators like a rising RSI and a potential MACD crossover show solid bullish momentum. Analysts are eyeing a $270 price target, pointing to more upside.

The Role of the EMA 150

A key technical indicator supporting Oracle's strength is its relationship with the Exponential Moving Average (EMA) 150. As shown in the chart, the EMA 150 currently sits around $170.70. Oracle's stock has consistently traded well above this long-term trend line, indicating sustained bullish sentiment and robust underlying strength. The significant distance between the current price and the EMA 150 underscores the powerful upward momentum and signals strong conviction from long-term investors.

Key Growth Drivers

Massive AI & Cloud Deals: Oracle's $3 billion push into AI-powered cloud data centers is big. But the buzz is around a potential $30 billion cloud contract with a major AI firm (likely OpenAI), set to significantly boost revenue by 2028. This deal alone is a game-changer, cementing Oracle as a "fourth hyperscaler."

Strong Financials: Beyond the hype, Oracle's fiscal 2025 revenue climbed 8.38% to $57.4 billion, driven by a 27% surge in cloud services. Net income jumped 18.88% to $12.44 billion, showing healthy profitability.

Bullish Wall Street: Leading firms like Jefferies and UBS are raising ORCL price targets to $270-$280, projecting 10-15% upside.

Why More Growth is Coming

- AI Infrastructure Leader: Oracle is building the critical cloud infrastructure (OCI) for the booming AI industry, partnering with giants like Nvidia.

- Big Future Forecasts: Analysts predict $5.30 EPS in 2026 and $104 billion in revenue by 2029, highlighting massive long-term potential.

- Outpacing Peers: Oracle's projected 16.62% earnings growth is set to outshine many competitors, indicating continued market outperformance.

Oracle has successfully transformed into a leading provider of cloud and AI infrastructure With powerful deals, solid financials, and a clear path for future growth, ORCL is a compelling stock to watch closely in the U.S. market.

Subscribe to our Blogs

Get the latest blog updates directly in your inbox.