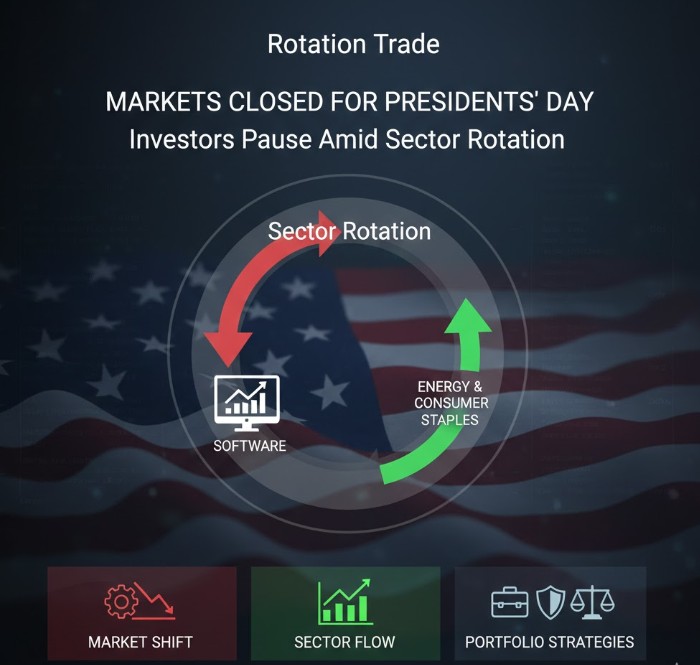

Presidents Day Market Pause: Rotation From Software to Energy

By Predictive Pick | February 19, 2026

U.S. equity markets are closed for Presidents Day, giving investors a

one-day pause from the recent rotation that sent money out of software and into

energy and consumer staples. That break matters because the selling in

high-growth technology names driven largely by concerns over artificial

intelligence’s disruptive effects on margins and business models has created

heightened sector volatility and broad re-pricing across the market.

The holiday closure is straightforward: the New York Stock Exchange and Nasdaq

will not trade on Presidents Day, while some futures and international markets

remain active. For investors, this is a scheduled pause rather than a

shock-triggered halt, but the timing arrives amid a notable shift in market

leadership.

Over recent sessions, traders rotated capital away from software and

other growth-heavy pockets and increased allocations to energy and consumer

staples, seeking earnings stability and cash flow predictability.

Sector Background and Recent Performance

Although no single company drives this broader move, software names

collectively accounted for outsized gains in prior years and have subsequently

borne the brunt of recent profit-taking. The Information Technology sector

registered some of the highest valuation multiples across the S&P 500 as

investors priced long-term growth into software platforms and AI-related

businesses.

Conversely, energy and consumer staples stocks have lagged in headline

performance but now attract investors seeking dividend yields and earnings

resilience amid macro uncertainty.

The compression of multiples in software has been accompanied by rising

interest in sectors with stronger near-term cash flows. Energy companies have

benefited from higher commodity prices and stronger shareholder returns, while

consumer staples appeal as defensive holdings that can dampen portfolio

volatility during a potential technology-led re-rating.

For many portfolio managers, the rotation is less about a single

earnings report and more about recalibrating risk exposures as AI reshapes

competitive dynamics.

What Is Driving the Rotation?

The core driver behind the recent selling pressure in software is

investor concern that accelerated adoption of artificial intelligence could

reshape revenue models and margin structures faster than companies can adapt.

For some software firms, AI presents a revenue opportunity. For others,

it introduces competitive threats that could compress pricing power or increase

R&D spending. That uneven impact has led investors to reassess which

software names deserve premium valuations.

Institutional flows amplify these moves. When hedge funds and mutual

funds rebalance, they often reduce positions that appear overvalued and

redeploy capital into sectors offering immediate earnings visibility. Energy

and consumer staples perceived respectively as cyclical cash generators and

defensive income plays have benefited from this reallocation.

The holiday break means these positioning changes are largely set before

markets reopen, leaving limited intraday liquidity to absorb additional

reallocations when trading resumes.

ETFs, Derivatives, and Liquidity Effects

Derivative and ETF activity has magnified the rotation. Sector ETFs such

as XLK (technology), XLE (energy), and XLP (consumer staples) have become focal

points for reallocations. ETF flows and futures positioning can accelerate

moves when headline risk emerges.

Options markets reflect heightened uncertainty: implied volatility for

many software names has ticked up, increasing the cost of hedging and prompting

some investors to prefer ETF exposure for sector bets. This dynamic can widen

bid-ask spreads and amplify price swings, particularly in the first sessions

after a holiday when liquidity is thinner.

Corporate Catalysts Ahead

Upcoming earnings and forward guidance will determine whether the

rotation persists.

- Companies

demonstrating accelerating revenue growth and positive free cash flow alongside

clear monetization of AI investments are more likely to regain investor

favor.

- Firms

unable to defend margins or justify premium valuations may continue to

experience multiple compression.

Market strategists broadly describe the shift as a classic sector

rotation rather than a systemic risk event. Analysts emphasize that while some

software names appear stretched relative to fundamentals, others maintain

strong balance sheets, expanding margins, and durable enterprise revenue

streams.

Sell-side research is advising selective pruning: trim exposure to

richly valued names while reviewing companies with sustainable growth and

robust profitability metrics.

What This Means for Investors Actionable Steps

- Re-evaluate

valuation risk: Consider partial profit-taking in

software names trading at extended multiples relative to peers.

- Be

selective in defensives: Increase exposure to dividend-producing

energy or consumer staples only where fundamentals support earnings

durability and cash conversion strength.

- Review

portfolio beta: Use the holiday pause to assess overall

volatility exposure and liquidity needs.

- Consider

hedging tools: Options collars, stop-loss strategies,

or partial trims can reduce downside risk without fully exiting long-term

tech convictions.

- Watch

earnings and macro data: Upcoming results and economic indicators

will likely determine whether this rotation deepens or reverses.

Conclusion

The Presidents Day closure offers a brief respite from daily trading

volatility, but the underlying drivers behind the recent shift valuation

reassessment in software and a search for stable cash flow will persist once

markets reopen.

Investors should use the pause to recalibrate exposures, distinguish

durable AI beneficiaries from speculative plays, and prepare for renewed

volatility tied to earnings and macro developments.

Disciplined positioning, valuation awareness, and a focus on sustainable

cash generation remain essential as markets digest the structural implications

of AI and broader economic uncertainty.

Summary: Investors rotated out of software into energy and consumer staples as they reassessed valuations and sought stable cash flows amid concerns about AI’s uneven impact on margins.

Subscribe to our Blogs

Get the latest blog updates directly in your inbox.