Seagate Technology (STX): Stock Investors and Traders Are Closely Watching

By Predictive Pick | September 1, 2025

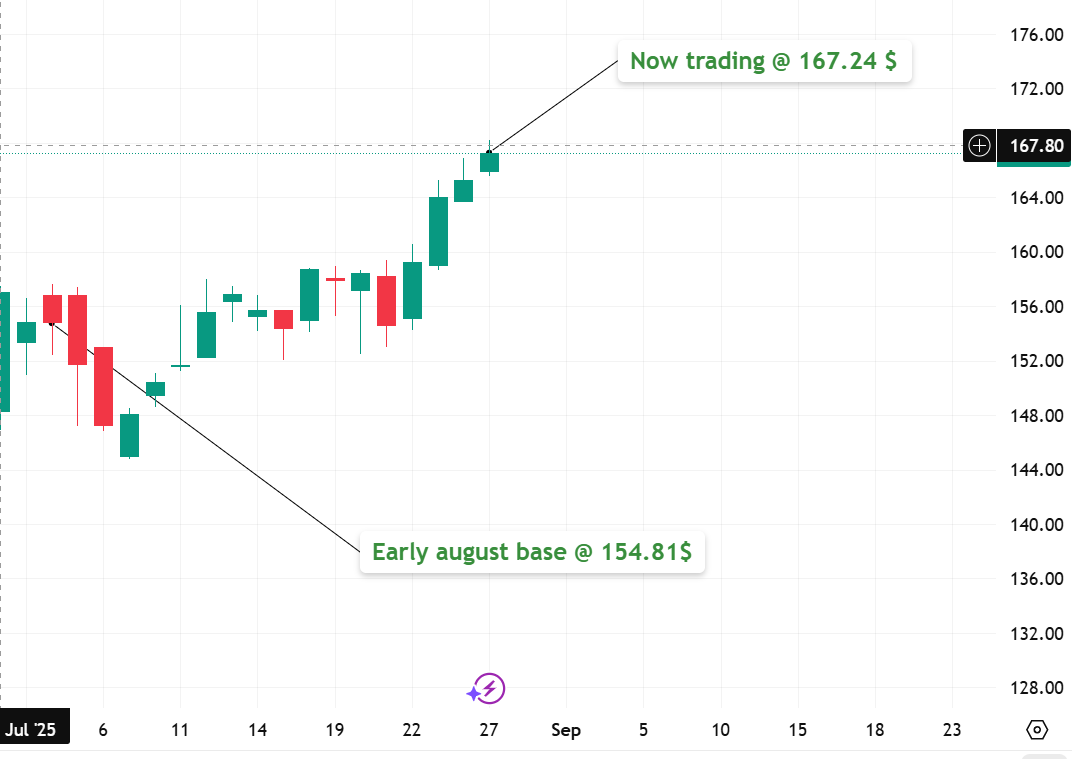

Seagate Technology (NASDAQ: STX) has moved from turnaround chatter to real momentum. Between August 4 and August 26, the stock rose from roughly $154.8 to $165.2, about a 6.7% gain with several volume-backed pushes that tell you institutions were participating, not just retail momentum. That kind of price action draws attention from both short-term traders and longer-term investors looking for a durable story.

What Seagate actually does (in simple terms)

Seagate builds mass-capacity storage: hard disk drives (HDDs), nearline enterprise SSDs, and integrated systems for cloud and data centers. Its products sit behind the data growth we all read about - backups, archives, hyperscale clouds, and increasingly AI model datasets where cost per terabyte matters. The company has been shipping higher-capacity HAMR-based drives (30TB and up) to meet rising data center demand.

Recent fundamentals that matter

Seagate closed fiscal 2025 on a strong note: non-GAAP EPS of $2.59 in Q4 and record fiscal-year revenue growth, signaling recovery and expanding margins after previous cycles. Free cash flow was healthy, and the company continued to return capital via dividends. Those are the numbers traders look for when deciding whether to hold through pullbacks.

Why the move could be sustainable: real catalysts

-

AI and data center tailwinds. Large language models and cloud workloads consume massive storage. Analysts and industry coverage point to big secular demand for mass-capacity drives, a direct tailwind for Seagate.

-

Technology moat (HAMR). Seagate’s HAMR roadmap gives it a cost-per-TB edge versus SSDs for cold and nearline storage. That keeps HDDs relevant at hyperscale.

-

Wall Street backing. Recent initiation/coverage and price targets from major houses (including a $170 target from Goldman) give the stock credibility and can draw institutional flows that fuel multi-week rallies.

How can STX grow from here (plausible paths)?

-

Volume expansion: As data centers scale, Seagate can push higher exabyte shipments via larger-capacity drives (40TB+ over the next 1–3 years). More bytes shipped = better top line and scale economics.

-

Mix shift to nearline & enterprise: Margin improvement if enterprise SSD/nearline sales mix increases and higher-value services or systems contribute more revenue.

-

Buybacks/dividends and multiple expansion: If growth sticks and cash flow remains strong, multiples could expand, especially with analyst upgrades and broader sector rotation into AI infrastructure names.

What traders should watch next?

-

Price action: Hold above the $162–165 zone for breakout confirmation; failure to hold could trigger a clean retest of $155.

-

Volume: Continued above-average volume on up-days confirms institutional participation.

-

Guidance & shipments: Any upside in guidance or accelerating exabyte shipments should reignite momentum.

Seagate’s August run didn’t happen in a vacuum; it was backed by an earnings beat, product roadmap progress (higher-capacity HAMR drives), and sector tailwinds tied to AI and cloud storage. That combo makes STX a name worth watching for both swing traders looking for a volume-backed breakout and investors who believe data growth will keep creating mass-capacity demand.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Please do your own research or consult a licensed advisor before making investment decisions.

References:

-

Seagate Q4 & FY2025 Earnings Release

-

Company Product Roadmap & Technology Overview (HAMR drives)

-

Analyst Coverage & Price Targets (Goldman, Citi)

-

Market Demand Drivers in AI/Data Centers

Subscribe to our Blogs

Get the latest blog updates directly in your inbox.